Are Foreign Currency Brokers Covered By Financial Compensation Scheme

This is a list of banks whose eligible depositors are covered by the UK’s Financial Services Compensation Scheme (FSCS) up to a limit of £85,000. You can find out more. about.

If the bank is not protected by the FSCS, your savings should still be covered by a compensation scheme in the country where the bank originates from, but it’s always best.

We are covered by the Financial Services Compensation Scheme (FSCS). The FSCS can pay compensation to depositors if a bank is unable to meet its financial obligations..

FSCS can pay compensation only for financial loss and there are limits to the amounts of compensation we can pay. The Scheme was set up mainly to assist private individuals,.

Probably not. In most cases, FSCS will no longer be able to protect customers of EEA branches of UK authorised firms that default (e.g. become insolvent).

Our FX margin is the difference between the Lloyds Bank exchange rate and the rate at which we buy and sell currency in the wholesale foreign exchange markets 1..

Eligible deposits with us are protected by the Financial Services Compensation Scheme (FSCS). Please note that due to FSCS and FOS eligibility criteria not all small business.

Industries: The FSCS is limited to financial institutions active in the UK economy. The type of deposits covered by the scheme includes mortgage arrangements, mortgages,.

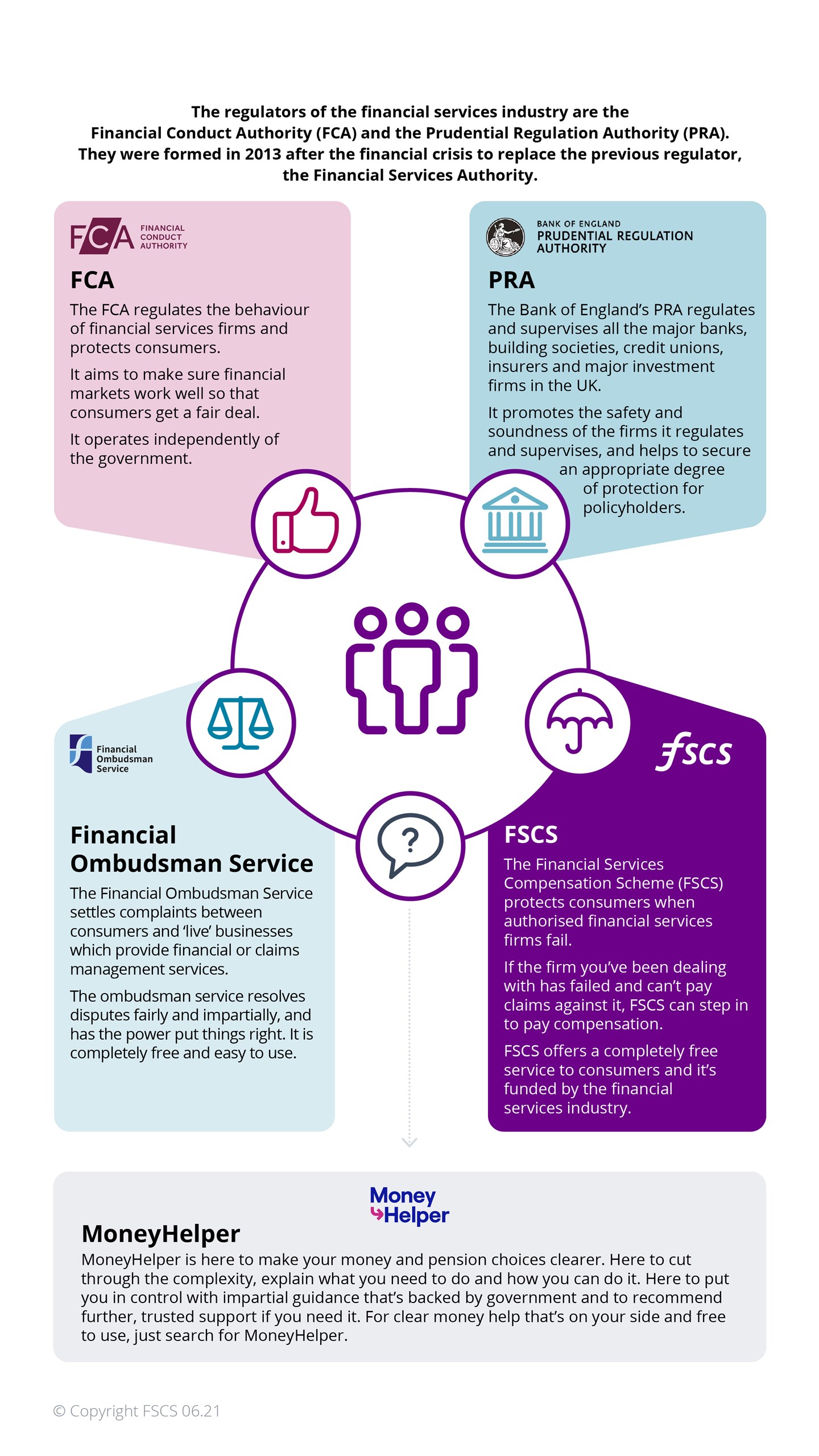

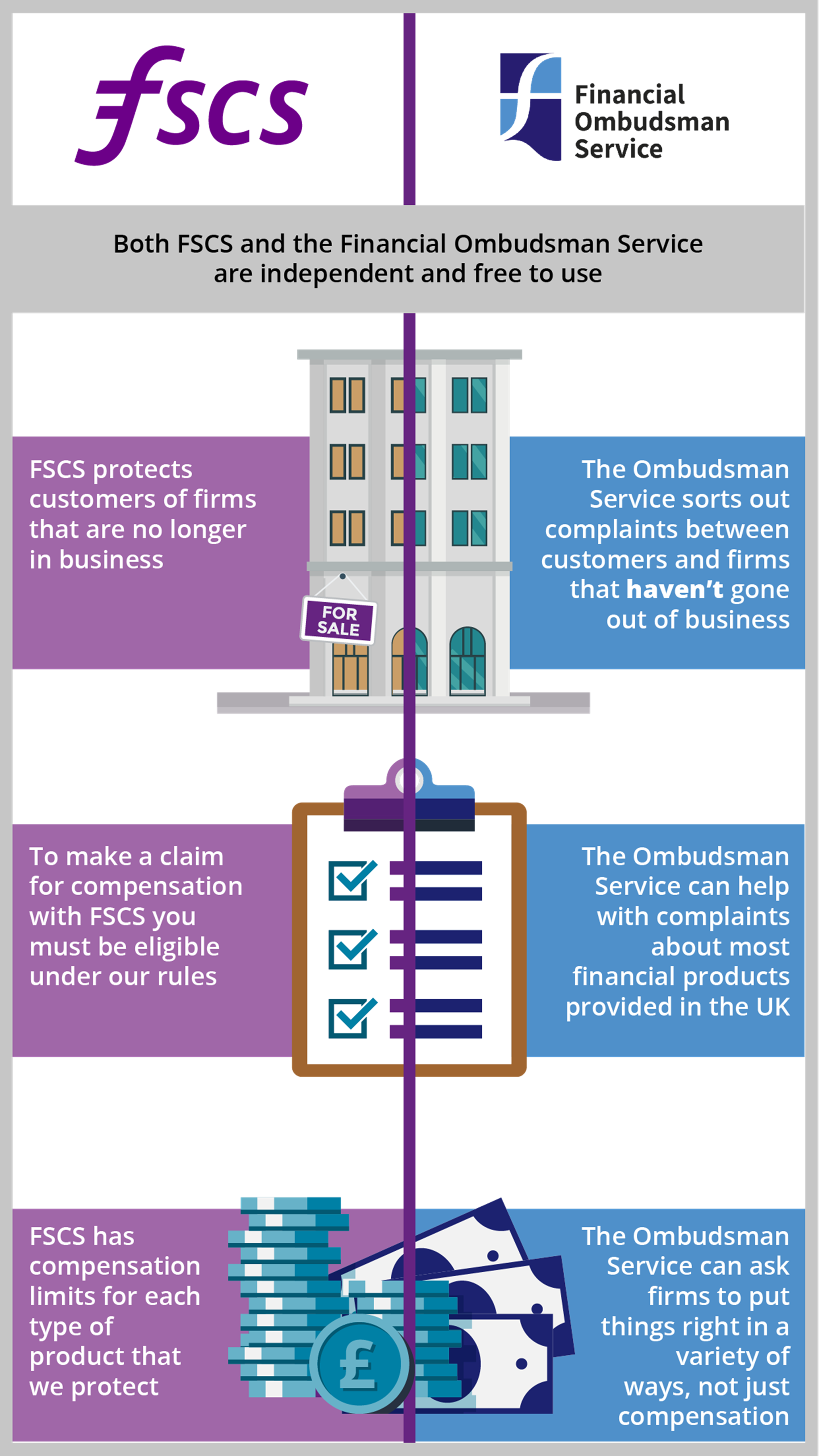

The Financial Services Compensation Scheme provides protection for customers of failed financial services firms. Overview FSCS-related news and publications FSCS protection.

If the bank is not protected by the FSCS, your savings should still be covered by a compensation scheme in the country where the bank originates from, but it’s always.

Eligible deposits with us are protected by the Financial Services Compensation Scheme (FSCS). We are covered by the Financial Ombudsman Service (FOS). Please note that.

Yes, foreign currency accounts with failed UK banks would be converted to GBP prior to compensation been paid. There is no residency requirement..

Cynergy Bank is a member of the Financial Services Compensation Scheme (FSCS). Your eligible deposits with Cynergy Bank are protected up to a total of £85,000 by the.

Your eligible deposit is covered by a statutory Deposit Guarantee Scheme. If insolvency of your bank, building society or credit union should occur, your eligible deposits would be.

Eligible deposits with us are protected by the Financial Services Compensation Scheme (FSCS). We are covered by the Financial Ombudsman Service (FOS). Please note that.

The FSCS covers £85,000 of savings per individual, per financial institution - so by placing your savings in a joint bank account along with your partner, you're effectively.

FSCS protects customers when authorised financial services firms fail. You could be entitled to compensation of up to £85,000. Discover how we can help you.

you get paid in a foreign currency, for example, for freelance work you own assets abroad such as investments, or property ... some offshore accounts are covered by other.

Lloyds Bank. Your eligible deposits held by a UK establishment of Lloyds Bank plc are protected up to a total of £85,000 by the Financial Services Compensation Scheme, the.

Financial Services Compensation Scheme (FSCS) of the FCA ensures investors' compensation when a broker has gone out of business. The FSCS claims to.

Guide to financial protection in the UK | FSCS

:max_bytes(150000):strip_icc()/netting.asp_v2-23d5e3c89eb24f0b817b16489bd7feed.png)

:max_bytes(150000):strip_icc()/margin-Final-872dda45cc4243cc958fe841e452a1b0.jpg)

:max_bytes(150000):strip_icc()/foreign-currency-swaps.asp-final-02bae8a217974bafb0705ac48de59d8d.png)

:max_bytes(150000):strip_icc()/terms_m_money_FINAL-bc556f9023f64a15b177e7768124f125.jpg)

:max_bytes(150000):strip_icc()/Tradefinance_final_rev_02-e456c914d9eb47a9ac069c396dd0f09b.png)

:max_bytes(150000):strip_icc()/bank-guarantee-4200955-1-6b0a6007286f4290a4c59366c1105945.jpg)

:max_bytes(150000):strip_icc()/hedge-fund-e24f63dddbea46509acc50e93e12132f.jpg)

:max_bytes(150000):strip_icc()/currency-peg.asp-final-fe79e540257844c99bf1fd4357f40a67.png)

:max_bytes(150000):strip_icc()/Forex_Final_4196203-e44848b06f2642378b12bc162951a818.png)

:max_bytes(150000):strip_icc()/foreignexchangerisk.asp-final2-9472143520d54e5f9ca0d8ea52a4af48.png)

:max_bytes(150000):strip_icc()/financial-market-Final-4459a12ee9f34aa98410afddd075c9c7.jpg)

:max_bytes(150000):strip_icc()/Moneymarket1-4be549284d2a4fc3804797292e8e1238.jpg)

:max_bytes(150000):strip_icc()/otc-ff2e9e69c97649c6938ecf5f0acb1f2f.png)

:max_bytes(150000):strip_icc()/Employee-Stock-Option-fffca69f497d469f9e0f6b0da712b06d.jpg)

:max_bytes(150000):strip_icc()/PaymentforOrderFlow-blue-7af2b9aa04334d12b4ba77517dedec50.jpg)

Vous pourriez aussi aimer

- Sujet Et Corrigé Brevet Histoire Pdf 2022

- Modele De Page De Garde Cahier Lycee

- One Piece 1085 Spoilers Fr

- La Rentrée De La Petite Sorcière Tapuscrit

- Ecole D Economie De La Sorbonne

- One Piece 1062 Date De Sortie

- A Tree Without Roots Chapter 22

- Addition Avec Retenue Ce1 à Imprimer

- Image Instruments De Musique à Imprimer

- Pages De Garde Cahier Lecture écriture

- Date De La Premiere Coupe Du Monde De Football

- Operation True Love Chapter 70

- 2019 2020 Page De Garde Cp Cahier Ecriture

- Jeu Des Différences à Imprimer Pdf

- A Bride's Story Manga Online

- Just To Untangle Your Shackles

- Expose Sur Le Chien

- The Surviving Girl And The Devils Egg

- Ici Tout Commence 10 Fevrier 2022

- My Affair With A Ghostly Girlfriend