Can You Release Money From Your Local Government Pension Scheme

For members of the Local Government Pension Scheme in England and Wales Your pension Thinking of leaving Opting out Opting out If the LGPS is not for you, you can.

Some companies offer to help you get money out of your pension before you’re 55. This could be an unauthorised payment. If it’s unauthorised, you pay up to 55% tax on it.

The arrangement you transfer from must normally be another registered pension scheme or a European pensions institution. You may be able to transfer in pension benefits from an.

If you elect to swap pension for lump sum, your pension will be reduced. Any survivor pension paid to your partner or eligible children will not be affected. You must tell your.

If you transfer your pension, you may: have to make payments to the new scheme; have to pay a fee to make the transfer; lose any right you had to take your pension at a certain age

You can release up to 100% of your pension fund as a cash sum, whether it originates from a Defined Contribution plan or Personal Pension, private sector Defined Benefits scheme.

You can usually take up to 25% of the amount built up in any pension as a tax-free lump sum. This is limited to a maximum of 25% of your available lifetime allowance. For most.

Taking money from your pension. If you have a defined contribution pension, you can usually start taking an income or lump sums (or both) from the age of 55. But be aware.

You can change your cookie settings at any time. ... Gurka Pension Scheme increase. Ref: 2023/06320. PDF, 231 KB, ... Housing and local services; Money and tax;.

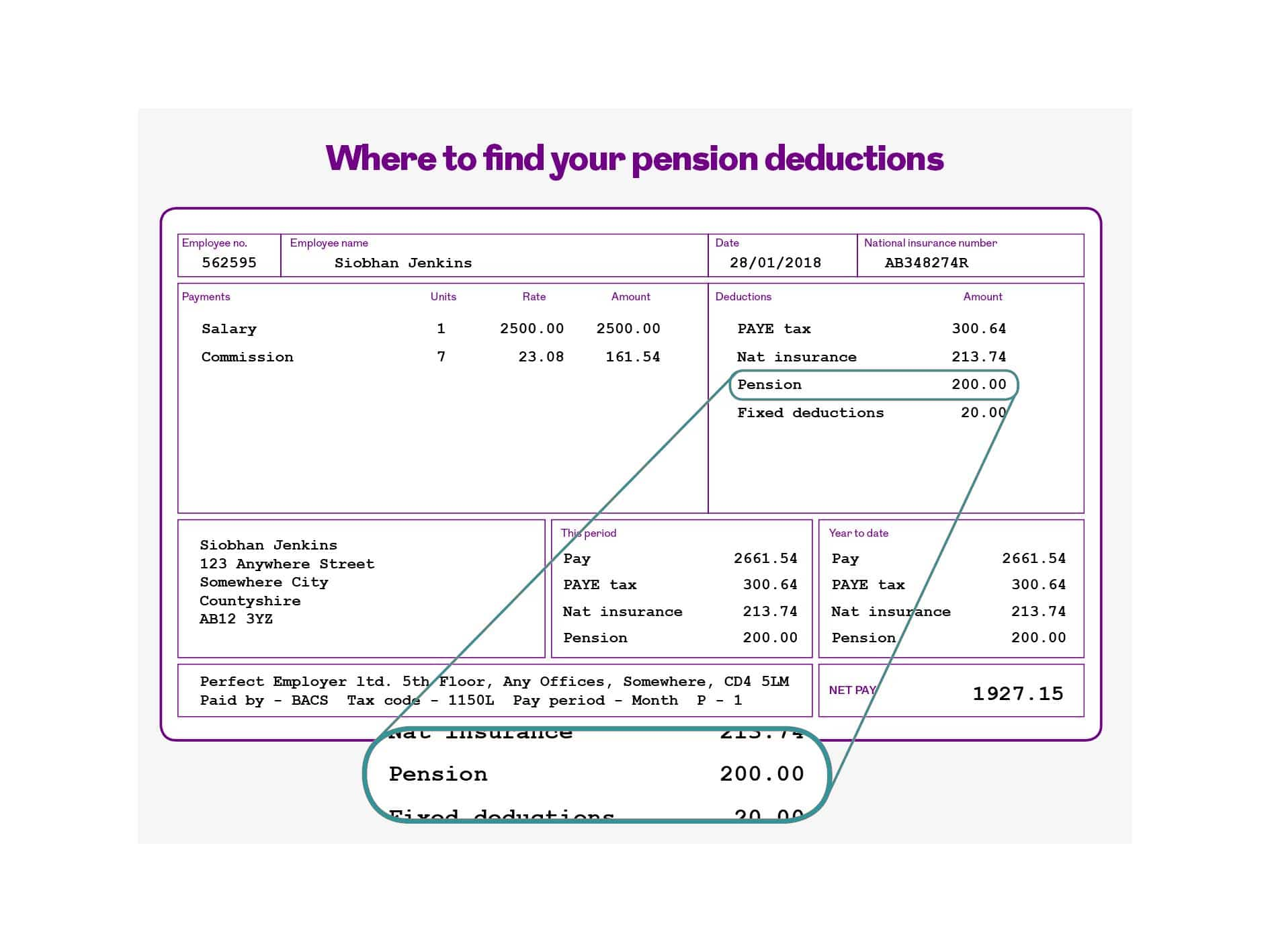

They will send you annual statements, telling you how much your fund is worth. You usually get tax relief on money you pay into a pension. Check with your provider that your.

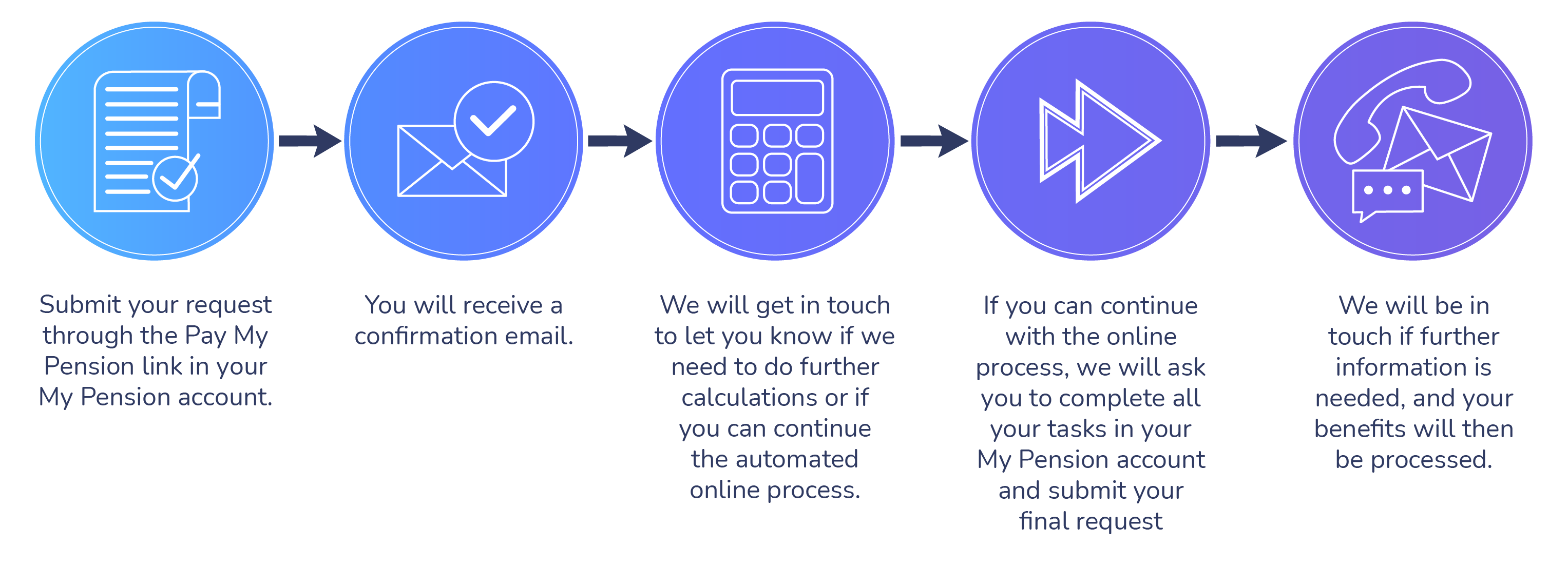

Request a refund — Pension Schemes Online service You can request a refund if your account is in overall credit. You do this by downloading and completing the.

+2 Transfer dilemma: Is it a good idea to move a local government final salary pension into a private scheme? Steve Webb replies: Those who have salary-related.

In normal circumstances, no you can't withdraw any of your pension before the age of 55 - without paying a huge tax penalty. Any pension savings withdrawn before the.

You do not have to take your refund immediately. You can delay payment for up to five years after leaving the LGPS, or until age 75 if this is sooner. Your pension fund must.

You can find all the information you need about Scotland's Local Government Pension Scheme by visiting the LGPS website including how your pension is calculated, when.

A refund of contributions can be paid when your length of service, or however long you have contributed to the scheme, is less than 2 years when you leave your job or opt out. Who.

If you have been a Local Government Pension Scheme (LGPS) Member for less than two years and have been made redundant, you’ll usually have three options: Claim a refund.

Yes, you should be able to transfer a LGPS pension into the NHS pension scheme. You will need to apply to make the transfer when you enrol with the NHS.

There is a real risk of a new generation of pension inequality if action is not taken. Pension schemes and providers should also equip women and men to better.

If he wants £50,000 a year, gross yearly income must be around £71,000. With a £40,000 workplace pension, approximately £31,222 after tax, he can make up the.

The LGPC provides technical advice and information on the Local Government Pension Scheme (LGPS) and related compensation matters to LGPS administering authorities.

What are the rules? The following rules apply if you want to transfer your LGPS to a DC pension to drawdown: You must have stopped paying into the scheme You cannot yet.

You can only transfer your LGPS pension if you have stopped paying into the Scheme. You cannot transfer an LGPS pension if you have already taken a pension from the LGPS. If.

Global scope: Those who are in regular contact with the UK's big pharma companies know how important it is for the UK to reconnect to the EU's Horizon £82bn.

Local Government Pension Scheme. Funds Guide - UNISON Shop

Vous pourriez aussi aimer

- Nitos Lazy Foreign World Syndrome 28

- Page De Garde Cahier Liaison Devoirs

- Miraculous Saison 5 Streaming Tf1

- Les Jeux Paralympiques 2024 : Un Aperçu Complet

- Dessin De Poésie Trois Petit Sapin

- Personnages De La Reine Des Neiges Cerf

- Gémo Chaussures Femme Confort

- Hunter X Hunter Brigade Fantome Personnage

- Alice In Borderland Manga Where To Read

- Who Made Me A Princess Chapter 1

- Cahier De Lecture Page De Garde 6eme

- Piece De 1 Euro Rare 2002

- Youngest Scion Of The Mages Chapter 21

- Page De Garde Cahier De Production écrite Et écrivain

- The Lazy Prince Becomes A Genius

- Dead Dead Demon s Dededede Destruction Read Online

- Koisuru Succubus No Ikenai Jijou

- Son Of Goblin Manga Chapter 1

- Keep It A Secret From Your Mother Webtoon

- Page De Gardes Cahier De Vie De Classe Gs