Which Financial Institution Has Introduced Know Your Customer Scheme

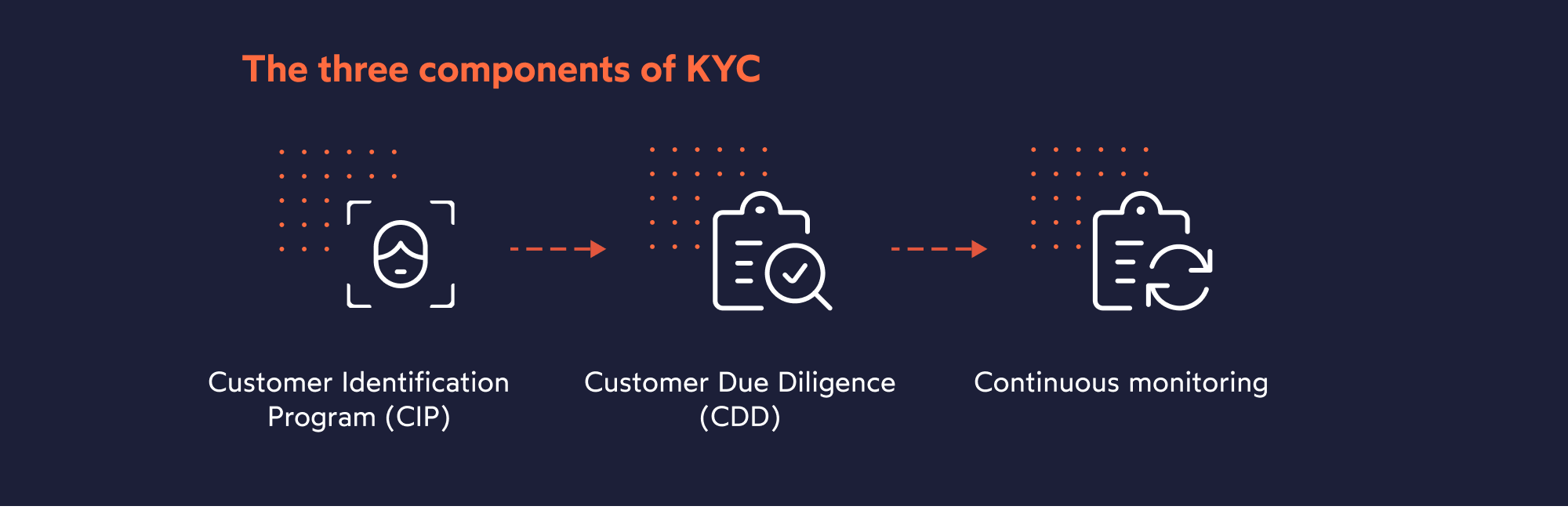

Know Your Customer (KYC) is a practice done by companies and other financial institutions to identify and verify their customers in compliance with the laws, regulations, and other.

KYC is a standard banking practice adopted globally to verify the identity of clients. It is the cornerstone of a robust anti-money laundering (AML) and counter-terrorist financing.

KYC, or know your customer, is a regulation that helps financial institutions prevent fraud by their customers. KYC involves constant check-ups and ongoing.

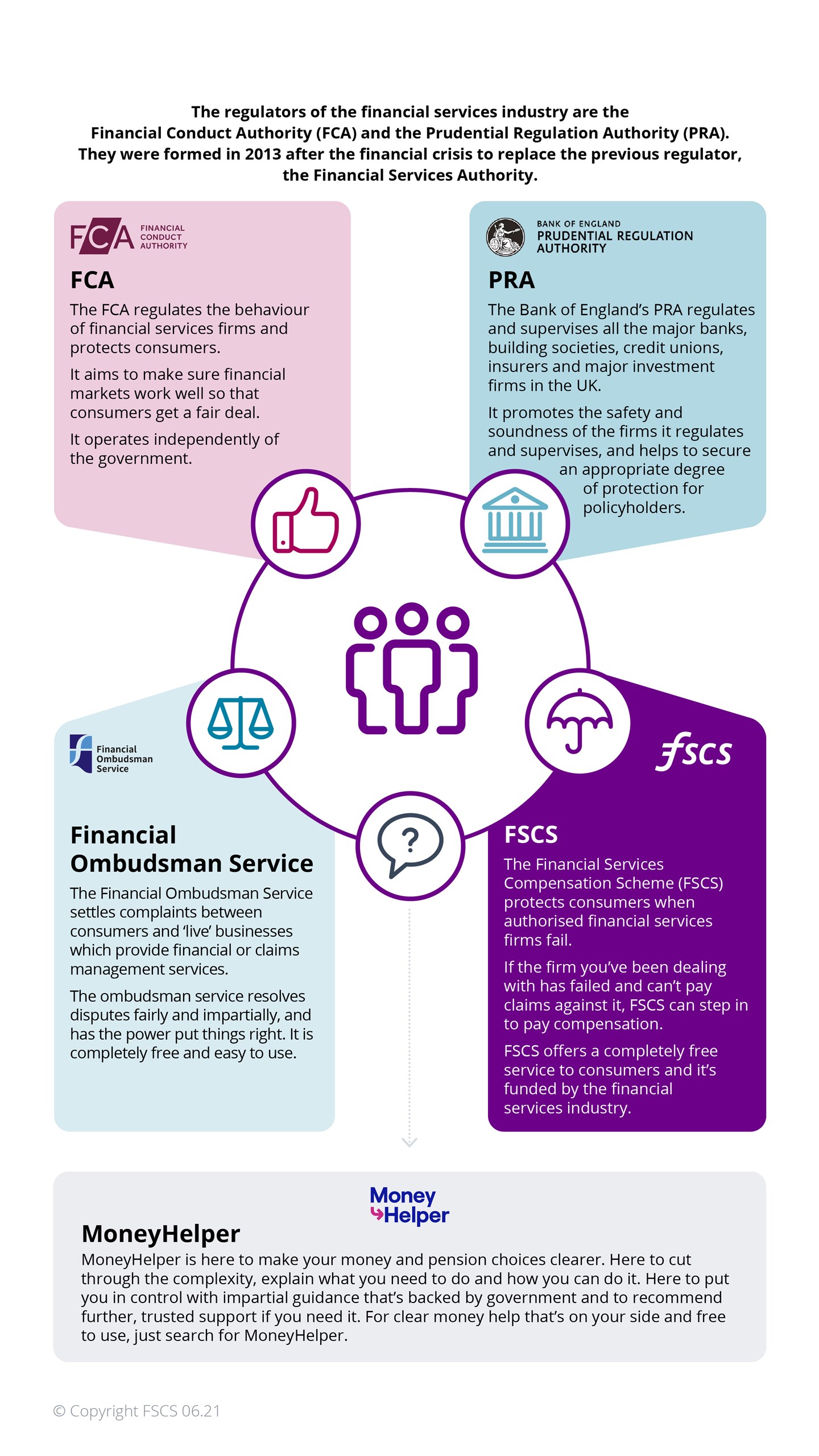

If your banking and saving brand does not appear in this table, you can ask them directly how your money is protected or check the Financial Services Register.

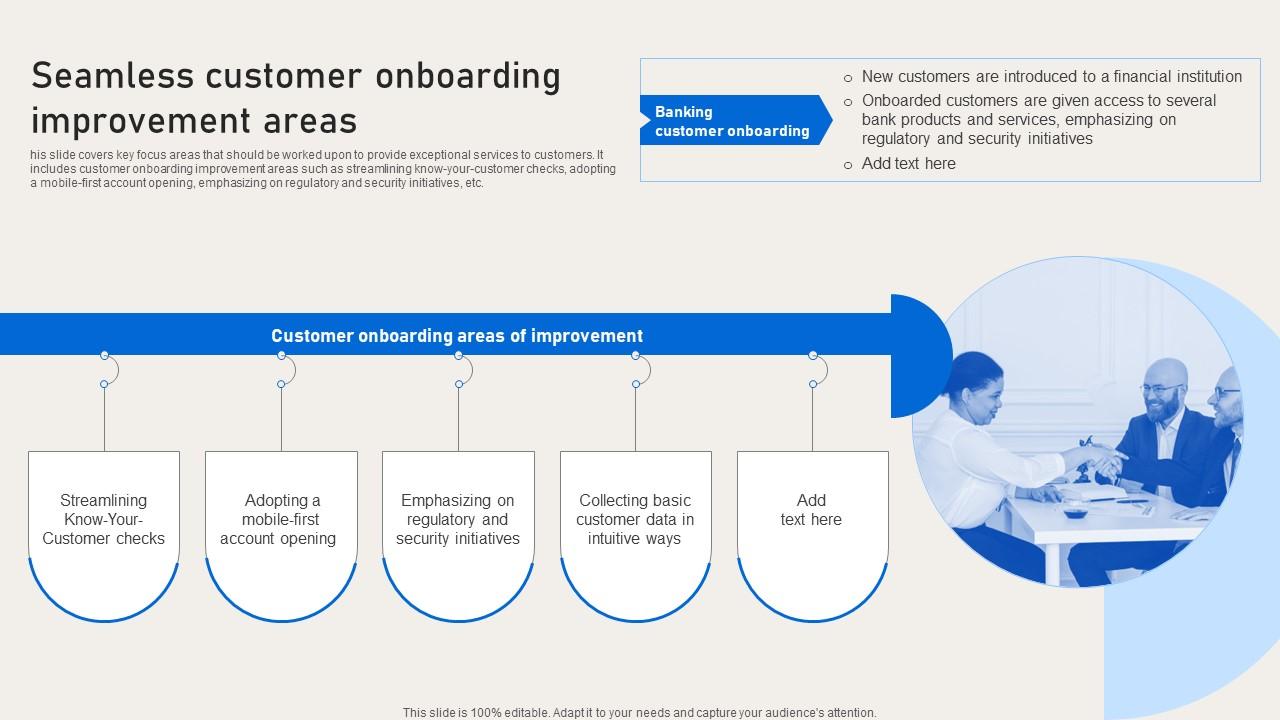

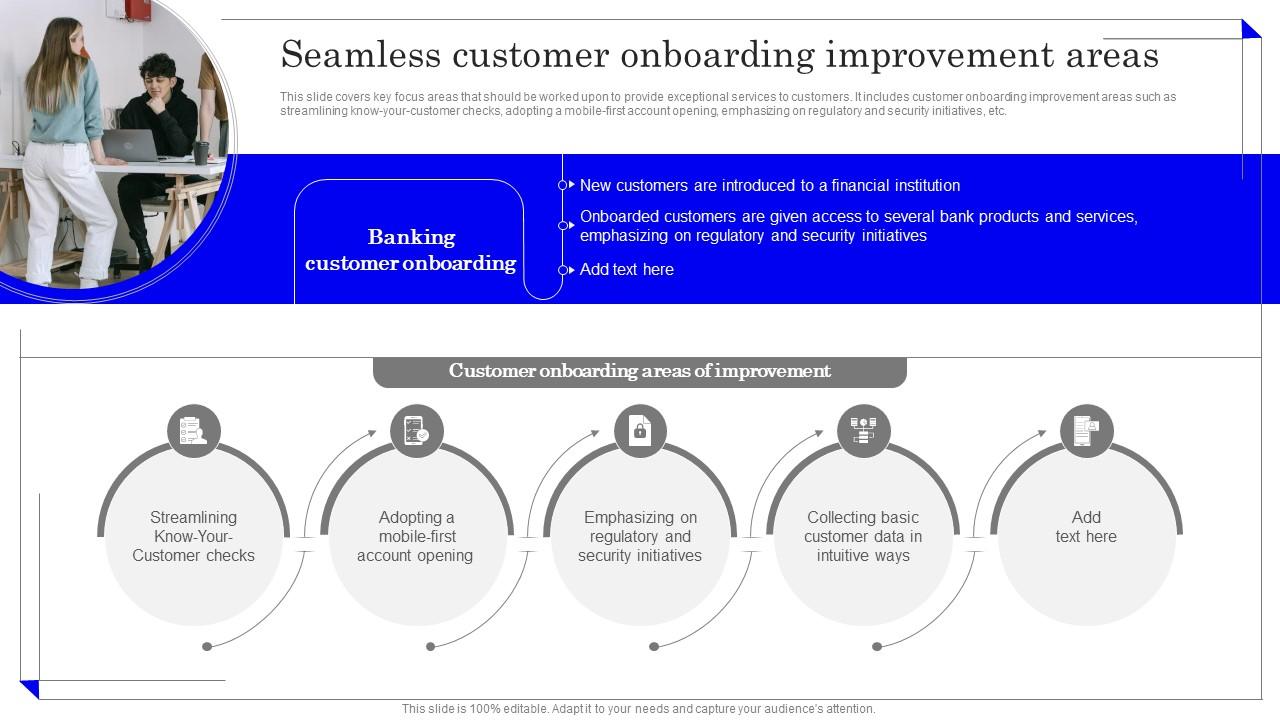

The Significance of “Know Your Customer” Platforms for Financial Institutions. KYC compliance, with KYC acting as an umbrella term for identity verification, refers to the.

The FSCS protects 100% of the first £85,000 you have saved, per UK-regulated financial institution (not per account). So in simple terms, if your bank were to.

Know your customer (KYC) is a bank regulation that financial institutions and other regulated companies must perform to identify their clients and ascertain relevant.

KYC references a set of guidelines that financial institutions and businesses follow to verify the identity, suitability, and risks of a current or potential customer. The goal is to identify.

Which bank introduced 'know your customer'scheme? Banks in the United States introduced the Know Your Customer Scheme to ensure that only valid customers.

Know Your Customer (KYC) standards are designed to protect financial institutions against fraud, corruption, money laundering and terrorist financing. KYC involves several steps.

What is KYC? Financial regulations to reduce fraud KYC regulations establish a customer’s identity and identify risk factors for fraud and other financial crimes. Learn.

Know Your Customer (KYC) refers to the policies and procedures put in place by businesses to manage risk and verify the identities of customers, clients and suppliers. KYC.

The Know Your Client (KYC) or Know Your Customer (KYC) is a process to verify the identity and other credentials of a financial services user. KYC is a regulatory process of.

Knowing your customer and assessing their needs. If you provide financial advice to retail clients, it's important to assess each customer's needs before making.

The FCA began consulting on a new consumer duty to introduce a higher and more consistent standard of consumer protection for financial services consumers by.

Which of the following institutions has introduced the 'Know Your Customer' guidelines for banks? A. IDBI. B. RBI. C. NABARD. D. SIDBI. Answer: Option B.

Financial consumer protection encompasses the laws, regulations, and institutional arrangements that safeguard consumers in the financial marketplace. This section offers.

In India, Electronic Know Your Customer or Electronic Know Your Client, or eKYC, is a process wherein the customer's identity and address are verified electronically through.

To understand how financial institutions have approached vulnerability in light of the FCA guidance (Financial Conduct Authority UK, 2021b), we accessed stakeholders from the.

Mar 07 2022 Data Analytics How Financial Institutions Can Build Better Customer Profiles in the Cloud In-depth customer data can help financial firms capture and keep consumer.

Guide to financial protection in the UK | FSCS

:max_bytes(150000):strip_icc()/know-your-client.asp-Final-05d7296a7d0242be985169322a7a17db.jpg)

:max_bytes(150000):strip_icc()/marketing-plan-ff4bce0e2c52493f909e631039c8f4ca.jpg)

:max_bytes(150000):strip_icc()/personalfinance_definition_final_0915-Final-977bed881e134785b4e75338d86dd463.jpg)

:max_bytes(150000):strip_icc()/financialinstitution-dc2ec0e00bc44e24adbb9c542f0a03e6.jpg)

:max_bytes(150000):strip_icc()/how-swift-system-works.asp-Final-b308a4e3bf8b439f9ab467bd298262ef.png)

:max_bytes(150000):strip_icc()/Business-Risk-04c7a4bb9cb94bba818125a01bbafb74.jpg)

:max_bytes(150000):strip_icc()/portfoliomanagement_final_definition_0819-8aeba5bb85224330888eeae6d2ffe1b4.jpg)

:max_bytes(150000):strip_icc()/bank-47189639b37541338a6f383147cba708.jpg)

:max_bytes(150000):strip_icc()/Marketing-Strategy-20dd671d870c4f1db1c9166de9e44e27.png)

:max_bytes(150000):strip_icc()/COMMERCIAL-BANK-FINAL-64996d1c0c1748d5994860dd9c190045.jpg)

:max_bytes(150000):strip_icc()/businessmodel-85ce9a0a59e642cd941204a92ee873de.png)

:max_bytes(150000):strip_icc()/TermDefinitions_BankIDnumber-d39a1dfb247e45b2814f94900dfed98d.jpg)

Vous pourriez aussi aimer

- Define The Relationship Manga Free

- Page De Garde Cahier De Sons 2018 2019 Pilotis

- Perfect Hypnosis In Another World

- To Love Your Enemy Chapter 1

- Joelle De Il Etait Une Fois

- Fushigi No Kuni No Arisugawa San

- The Villainess Wants To Enjoy A Carefree Married Life

- Konya Wa Tsuki Ga Kirei Desu Ga Toriaezu Shi Ne

- Is This Hero For Real Chapter 69

- Craft Game No Nouryoku De Isekai Kouryaku

- Page De Garde Cahier Réusiite Maternelle Modifiable

- Listening To The Stars Manga

- Je Reviens Au Coeur De La Louange

- The Beast Tamed By The Villainess Chapter 33

- Encanto : La Fantastique Famille Madrigal The Family Madrigal

- The White Cat's Divine Scratching Post

- Overlord Light Novel Volume 14

- Les 10 Vierges Dans La Bible

- Dangerous Convenience Store Chapter 40

- My Happy Marriage Light Novel Read Online Free